[ad_1]

Michael M. Santiago/Getty Images News

In recent months, electric-vehicle stocks have underperformed. Whether it’s Rivian Automotive, Inc. (NASDAQ:RIVN), Lucid Motors (LCID), or Nikola Corporation (NKLA), the electric-vehicle sector has lost some of its allure as a result of a crippling supply-chain issue. This loss of attractiveness may also provide motivation for investing in beaten-down electric-vehicle startups such as Rivian Automotive.

In my opinion, the electric-vehicle maker has the lowest production risks in the industry, thanks to a massive $16.4 billion cash pile that now accounts for 65% of the company’s market value. Rivian Automotive’s stock is attractively valued ex-cash.

Rivian Automotive’s Production And Pre-Order Status

Rivian Automotive affirmed in May that its previous production forecast of 25K units in 2022 remains unchanged. In March, the EV manufacturer reduced its production forecast from 50K to 25K vehicles due to continued supply-chain issues. Rivian Automotive’s affirmation of the 25K unit production target lowers risks for the EV company, as there was a danger that supply-chain issues would have deteriorated to the point where management would have reduced its production guidance again.

Rivian has over 90K pre-orders from clients in the United States and Canada as of May 9, creating a large order backlog that will likely take the corporation more than two years to work through. Despite raising electric-vehicle pricing by up to 20% in March, Rivian Automotive was able to add 10K R1 pre-orders, demonstrating that higher prices do not deter purchasers.

Rivian Automotive also revealed the number of vehicles produced and delivered in 1Q-22, in addition to confirming the 2022 production forecast. Rivian Automotive built 2,553 electric-vehicles in 1Q-22 and delivered 1,227 of them for $95 million in sales.

Rivian Automotive produced nearly 5K electric-vehicles across two vehicle platforms since the start of production, which is more than double the amount produced on March 8, when Rivian Automotive reported it produced a total of 2,425 electric-vehicles.

What will be most important to Rivian Automotive in the future is its ability to grow production swiftly. The EV firm intends to produce 600K electric-vehicles per year, including the R1T, R1S, and EDV. The EDV is available in two sizes: the EDV 700, which is intended to be the workhorse of Amazon’s delivery fleet, and the EDV 500, which is a smaller variant.

Rivian Automotive’s manufacturing capacity is expected to grow significantly over the next two to three years as the EV manufacturer focuses the production and delivery ramp of its numerous models. Rivian Automotive currently has an installed production capacity of 150K units in Illinois, but plans to increase yearly output to 1 million electric-vehicles by the end of the decade.

Financial Results For 1Q-22

Rivian Automotive is losing money like crazy, but that’s to be anticipated. The company is currently focusing on increasing R1T, R1S, and EDV production and working through production hiccups to run its factory more efficiently in 2022.

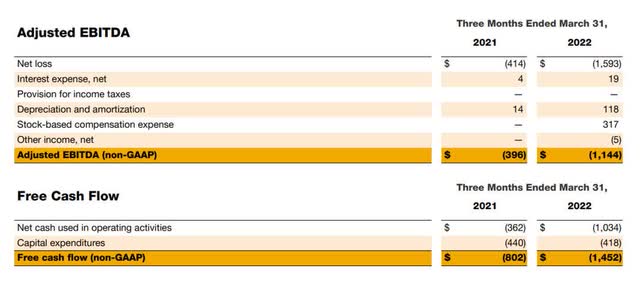

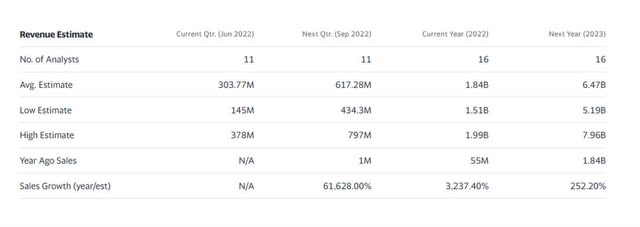

Despite significant losses, Rivian Automotive’s results are expected to improve considerably in 2023. Rivian Automotive’s loss on an adjusted EBITDA basis in 1Q-22 was four times that of the previous year. However, as manufacturing ramps up in 2H-22, investors should begin to notice significant revenue implications. Rivian Automotive’s revenues are expected to climb 252% to $6.47 billion next year, according to the market.

Adjusted EBITDA (Rivian Automotive)

Rivian Automotive’s Low Risk Stems For Its Exceptional Balance Sheet

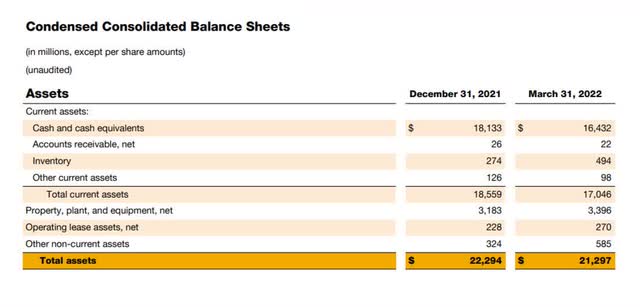

What EV company do you know that has more than $16 billion in cash lying on its balance sheet, waiting to be used? Exactly.

Rivian Automotive’s massive cash reserves allow the EV company to increase production without worrying about raising additional financing from investors, which I imagine is becoming more difficult now that the U.S. economy is on the verge of a crisis and investors are increasingly risk-averse.

Aside from having more than enough cash to support the scaling of production and deliveries, Rivian Automotive’s balance sheet cash of $16.4 billion represents an incredible 65% of the company’s market value.

Condensed Consolidated Balance Sheets (Rivian Automotive)

Rivian Automotive has around $18.24 per share in cash, leaving $9.76 per share to value the company’s profitable EV operations (facilities, service and distribution network, IP, etc.). Based on 901 million class A and class B shares outstanding, the cumulative equity value of Rivian Automotive’s operations is thus $8.8 billion.

Rivian Automotive has a sales multiple of 1.4x, adjusted for the company’s considerable capital resources, with expected 2023 sales of $6.5 billion. A sales multiple of 1.4x is low for an electric-vehicle firm that is expected to grow by 252% next year, according to the market. Rivian Automotive has a sales multiple of 3.9x without a cash adjustment.

Revenue Estimate (Rivian Automotive)

Why Rivian Stock Could Fall

Supply-chain issues and inflation are two of the most concerning aspects of establishing an electric-vehicle firm. So far, higher unit prices and lengthier waiting lists have not deterred consumers, and the fact that the company added 10K fresh pre-orders to its reservation lists indicates that Rivian Automotive’s EVs are in high demand. A larger-than-expected economic slowdown and rising component prices could scare investors away from the electric-vehicle sector, where most companies are still losing money.

My Conclusion

Rivian Automotive’s stock price has dropped in 2022, but the firm is making headway in expanding production capacity, and price increases have not dampened customer interest or demand. Rivian Automotive’s bank sheet and cash strength set the company apart from competitors who must increase manufacturing with far fewer resources.

Rivian Automotive may be the EV manufacturer with the most potential and the least amount of risk because it is only at the beginning of its multi-year path to become a global leader in the electric-vehicle market.

[ad_2]

Source link

More Stories

Business Ad Trends in an Age of Social Media

Conveniently Find Cheap Auto Insurance Online

What Makes a Lamborghini Engine So Special?