[ad_1]

Mainland Chinese medium- and large-obligation vehicles (MHDTs) have

entered a bear marketplace because mid-2021. Whilst the marketplace staged a

slight recovery adhering to the easing of power shortages and

injection of coverage stimulus from late past 12 months, surprising

headwinds introduced by the Russia-Ukraine disaster and domestic Omicron

outbreak plunged the market place back again into weakness in the next

quarter of 2022. Amid pandemic-induced lockdowns in Jilin and

Shanghai, manufacturing of MHDT hit the most affordable reading for April more than

a ten years. In our May perhaps forecast, we downgraded the mainland Chinese

MHDT creation for 2022 by 5% to 1.13 million units, a decline of

23% as opposed with 2021.

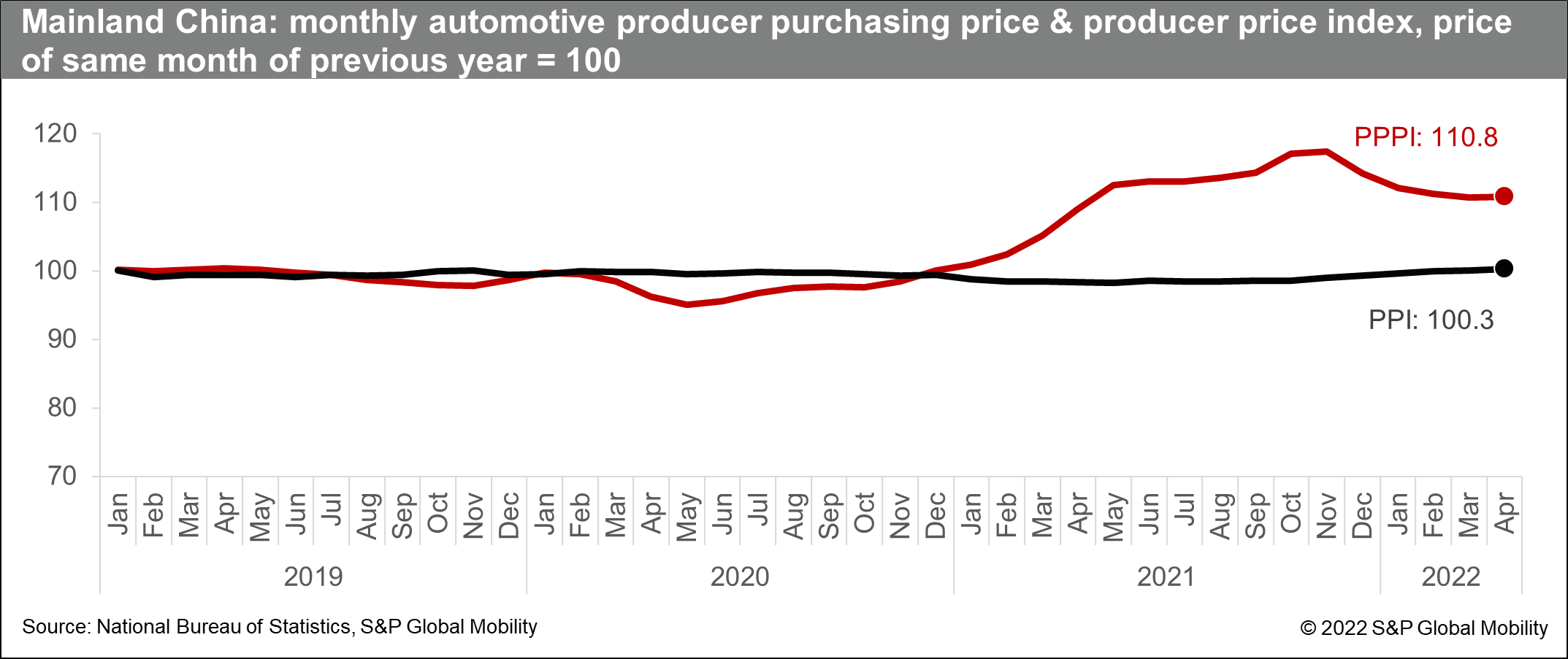

Exterior geopolitical tensions push up producer fees

As raw elements depict 20-30% of the price tag of production for

heavy vans, uncooked material prices partly decide the

profitability of truck producers. Owing to the world-wide financial

restoration from the COVID-19 scare, commodity rates have

undergone an upcycle due to the fact late 2020. The rally received much more steam

in the initial quarter of 2022 with the outbreak of the

Russia-Ukraine war. Particularly, the cold-rolled metal rate that

accounts for more than 60% of the overall uncooked content expenses for a heavy

truck surged by 3% in March 2022 from the amount of January,

expanding the advancement to more than 40% as compared to the similar

time period of 2020. Also, the diesel price elevated by 15% and handed the

RMB9,000 for each metric ton mark by January-March 2022. In

distinction, the movement of providing price ranges for significant vans had been

alternatively flat less than slack demand, as gasoline value inflation elevated

the operating expenses whilst oversupplied trucking constrained freight

rate expansion. As a consequence, the truck producers’ obtaining and

promoting prices logged sizeable differentiation, even with an

maximize in cost of CN6-stage versions. This sort of weak inflation

move-by way of impact has designed truck makers to bear the brunt of the

income margin squeeze primarily just after dumping of CN5-amount vehicles.

With the Russia-Ukraine crisis predicted to deepen into 2023,

limited-term truck manufacturing is for that reason minimize by all over 25,000 units

in the May perhaps outlook.

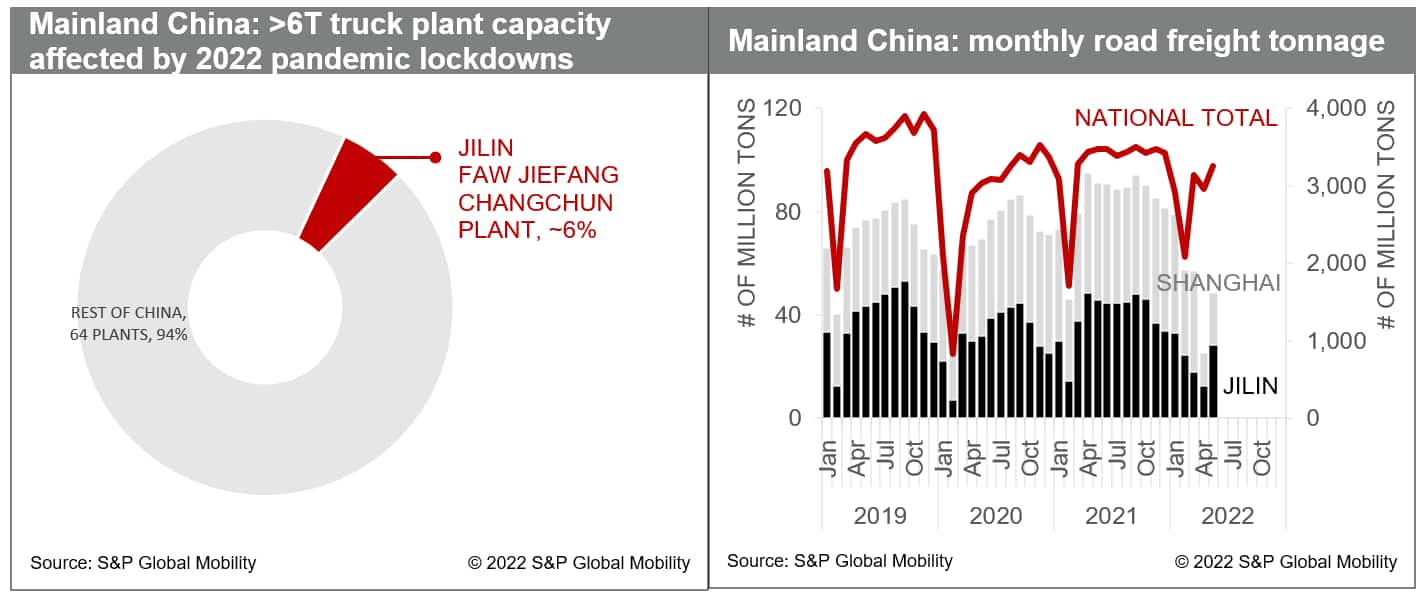

Inner pandemic resurgences exacerbate source chain

disruptions

The Omicron wave had brought on massive lockdowns in Jilin

Province (March 11-April 28), Shenzhen Town (March 14-20), and

Shanghai Metropolis (March 28-May well 31) considering the fact that March 2022, resulting in

popular organization disruptions and logistics snarls. Despite the fact that

there are number of MHDT makers in the epicenters of the pandemic,

Changchun City and Shanghai City host around 40 major source bases

serving core parts to mainstream types covering earlier mentioned 90% of

truck output. Starting up from mid-April, FAW Jiefang’s Changchun

plant and most suppliers managed to resume do the job in the closed-loop

program, but labor shortages beneath the mobility control disabled

them to perform at regular ability. In the meantime, demanding

containment actions these kinds of as site visitors constraints, nucleic acid

examination and quarantine demands, as effectively as closure of toll

stations pent up highway freight desire and prompted broader repercussions

of element shortages, which in change dampening truck output.

Under the conditions, the full decline of MHDT production in the

next quarter is approximated to achieve 100,000 units. With ramping up

efforts to smooth logistics and restore small business, the function

resumption amount of enterprises higher than selected dimensions in Shanghai

City enhanced to 96% by mid-June and will absolutely recuperate from July.

Coupled with expansionary insurance policies and adequate capacity

reserves, these could support MHDT manufacturing to decide up and offset

the pandemic-induced loss in the 2nd fifty percent.

A even more downgrade to outlook is less than evaluation, as the

government’s reliance on the “dynamic zero-COVID” strategy and

money outflows led by the Fed’s tightened cycle are possible to

weaken business sentiment and subdue need restoration. On the other

hand, the rebuilding of vendor inventories of CN6-amount MHDTs

climbed from 280,000 models in early this 12 months to 380,000 models by

April, way better than the usual rates of 150,000-170,000 units.

Moreover, there were being a lot more than 70,000 models CN5-stage new

vans (bought as used vans) remaining in the current market, exacerbating

de-stocking pressures.

This report was posted by S&P World-wide Mobility and not by S&P Worldwide Ratings, which is a separately managed division of S&P World wide.

[ad_2]

Resource hyperlink

More Stories

Women’s Motorcycle Jackets Vs Men’s Motorcycle Jackets

What to Do After a Motorcycle Accident?

Understanding The Benefits Of Motorcycle Gloves