[ad_1]

While the March 2022 forecast update mirrored the influence of

Russia’s invasion of Ukraine, the April update addresses some

supplemental difficulties that have arisen, such as a rather sluggish

restoration in semiconductor provides, the effects of further COVID

lockdowns in China and the longer-phrase influence of high uncooked

substance selling prices that will set additional strain on new auto

affordability.

“Presently the greatest hazard to the outlook will come from the

danger of further or extended lockdowns in mainland China and the

contagion into already pressured world supply chains,” stated Mark

Fulthorpe, Government Director, World-wide Production Forecasting,

S&P World-wide Mobility.

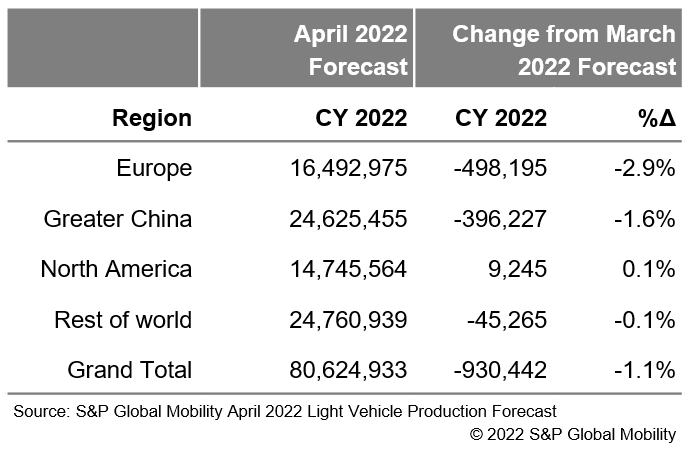

The April 2022 forecast update demonstrates noteworthy reductions

for numerous markets, with the most important reductions focused

on Europe and Larger China.

The subsequent demonstrates the S&P Global Mobility April 2022

Gentle Car Output Forecast update:

The extra noteworthy regional adjustments with the latest

forecast update are in-depth below:

- Europe: The outlook for Europe light auto

production was minimized by 498,000 units for 2022. With the April

update, we see European output remaining challenged as the

area carries on to navigate the Russia/Ukraine affect as properly as

ongoing supply chain challenges. - Bigger China: The outlook for Higher China

light-weight auto production was reduced by 396,000 units for 2022.

Heavily strike by strict COVID containment measures, light-weight car or truck

production in March is believed to have declined by 8% a

yr-above-year. In April, the Omicron variant has spread to

Shanghai and compelled regional government officials to put into practice

in depth lockdowns. As the affect of lockdowns expanded

from car or truck production to sections output, component shortages

are predicted to interrupt automobile output outside of Shanghai in

the around-phrase, top to further more motor vehicle output impact in

subsequent months. - North The united states: In spite of the backdrop of the

Russia/Ukraine conflict and continued supply chain challenges, the

outlook for North American light-weight car or truck generation in 2022 remains

flat at 14.75 million models. Output in Q1-2022 came in a bit

larger than forecast with 3.55 million units produced. However,

creation in Q2- 2022 was revised down on ongoing supply chain

struggles and problems surrounding extra logistics issues at

border crossings involving the US and Mexico in Texas that may possibly

exacerbate already strained disorders in the in close proximity to-phrase.

This post was released by S&P Worldwide Mobility and not by S&P World-wide Ratings, which is a separately managed division of S&P World-wide.

[ad_2]

Supply link

More Stories

Business Ad Trends in an Age of Social Media

Conveniently Find Cheap Auto Insurance Online

What Makes a Lamborghini Engine So Special?